with over 25K net mineral acres and 10K+ leases acquired.

Frequently asked questions

Every well is drilled inside a drilling unit, and it’s rare for one company to own 100% of the leases or working interest in that unit. Typically, the company holding the majority of the leases petitions the state governing body to be declared the Operator of the unit. The other companies owning leases in the unit become Non-Operating Working Interest Partners.

The Operator handles the drilling and completion operations, gathers the oil and gas for sales, and manages the entire process from drilling to sales and beyond. Non-Op Partners cover their share of the drilling and completion expenses, they pay their share of the ongoing operational expenses, and they receive revenue from the sale of the produced oil and gas. Essentially, the Operator’s expertise in operations benefits all partners, aligning their interests almost completely.

Basin sources quality projects with best in class Operators. As a Non-Op Working Interest Partner, we are able to leverage the Operator’s expertise and operational experience while sharing in the same revenues. This setup significantly de-risks the highly lucrative oil and gas returns by utilizing decades of operational experience across various plays nationwide. It offers capital investment flexibility, less asset-level risk, potential cost reductions, and improved value capture through strategic alignment and partnerships.

A Non-Op Working Interest investment potentially offers the highest IRR in any investment class, significantly de-risked by Basin’s decades of expertise and industry relationships. These investments should also be a key part of your yearly tax strategy as the tax benefits specific to Working Interests are likely more robust and impactful than any other found in the current tax code.

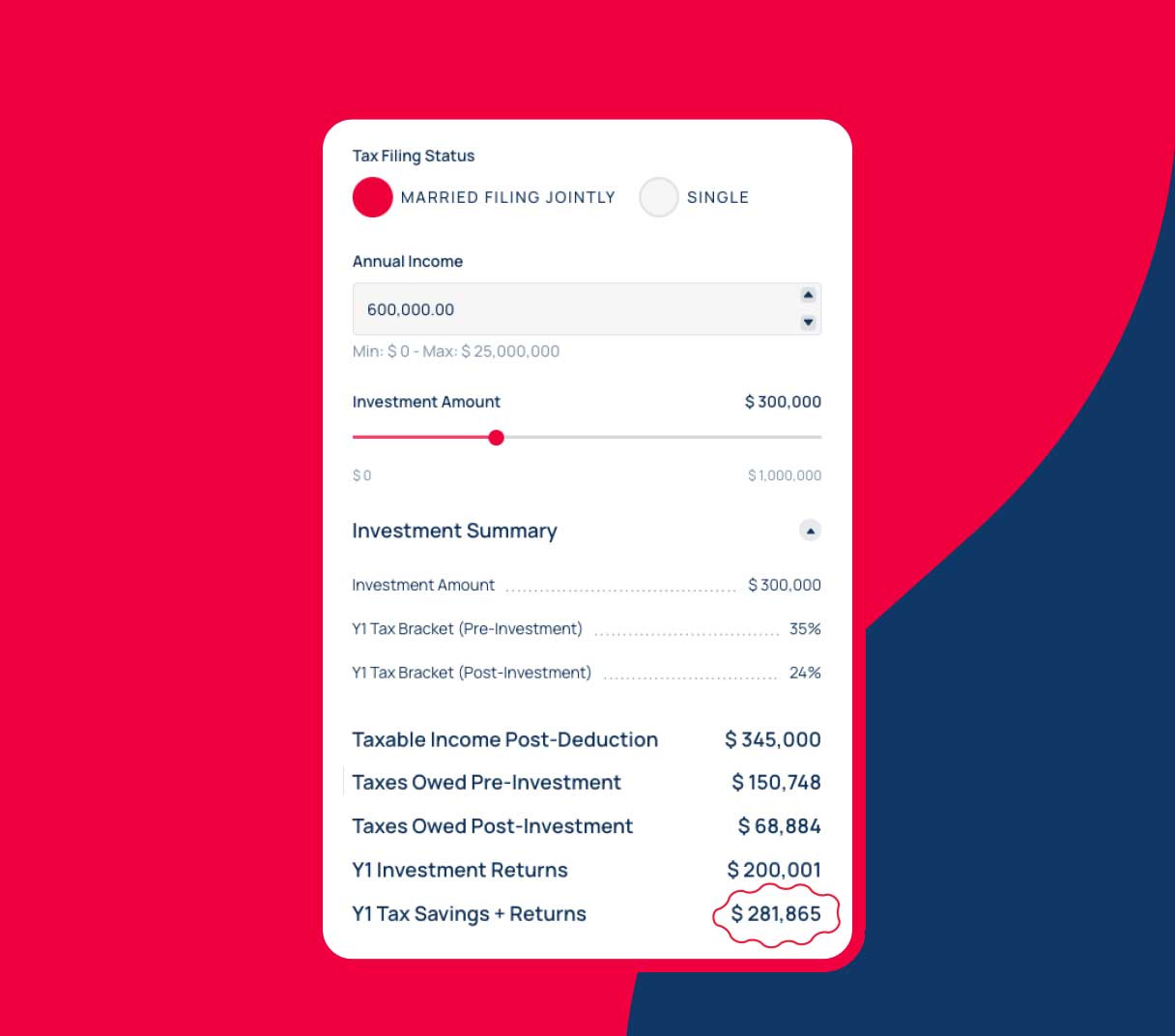

Every individual’s tax situation is different, so please consult your own tax professional for information related to your specific circumstances. Generally speaking, however, as much as 85-90% of your investment can be deducted from your yearly earned income, dollar for dollar. The remaining is depreciated over the course of the next several years. In addition, the first 15% of your yearly investment revenues is tax free! For more detailed information, please review our CPA’s information provided here, while also consulting your CPA.

Unlike many in the energy fund and private equity space, we are not bankers, we are not salesmen, and we didn’t spend the vast majority of our oil and gas careers inside private equity shops or on Wall Street. Our team touts decades of real, hands-on experience in the oil and gas industry, at the field level and beyond. Over those decades, we’ve formed successful ongoing relationships with top operators across the nation, which provides us opportunities that most do not see.

Our direct oil and gas expertise, coupled with our strategic partnerships with independent third-party petroleum engineers at Haas & Cobb and CPAs at Milbern Ray & Co, provide us the analytical horsepower to mitigate risk and increase value for our investors in any economic climate.

Every drilling project is different, be it in the same oil and gas play or not. In some cases, wells can be drilled and completed within 30-45 days. In other cases, it can take as long as 6 months or more, depending on a variety of factors. All of these things are considered by Basin management as we determine the best opportunities for our and our investors’ capital.

Typically, capital is deployed within 60 days of being called.

Each investment is unique, but we target projects that provide a reasonable expectation to generate our investors an IRR of 25% or greater, while returning their entire initial investment within the first 3 years following first production of a well/unit. These figures are further multiplied when the full tax benefits are factored into the equation.

For an estimate on what these numbers could look like for you, take a spin on our Investment Calculator. Generally, first revenues are delivered to Basin, by the operator, within six months of first production of a well/unit. Basin provides quarterly revenue distributions to our investors on all their investments with us.